WriteMark

Plain Language Standard

Three reasons to get the WriteMark® on shorter documents

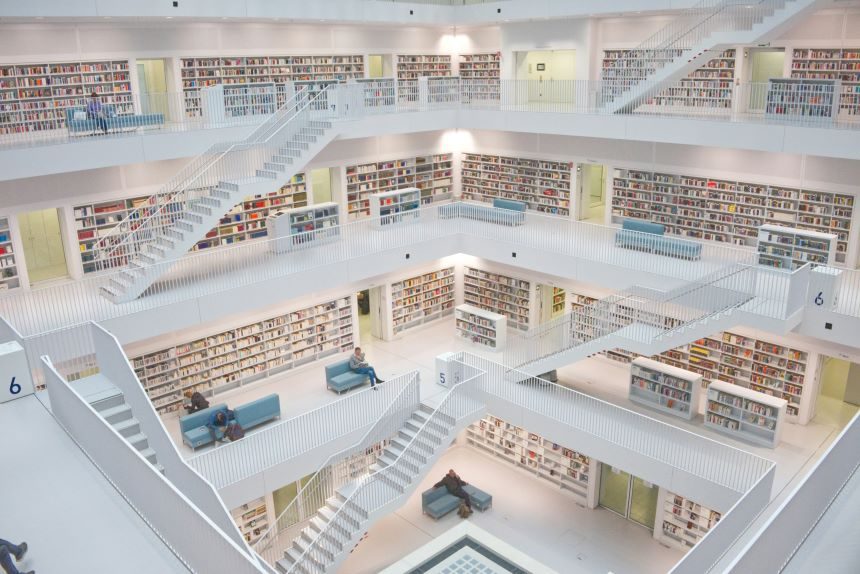

We’d love to help you achieve the WriteMark on the whole library of documents you use to communicate with customers | Photo by Niklas Ohlrogge on Unsplash.

Most documents that hold the WriteMark® are on the longer side. Achieving the Standard takes time and effort. That time and effort feels better spent when — at the end of it all — you can proudly display the WriteMark® logo on an important 100-page document, rather than an everyday 1-pager, right?

But which of your public-facing documents do people look at most often? Which do you think your customers are more likely to read from start to finish?

You’ll get the best value out of the WriteMark® by achieving the Standard and displaying the logo on the documents that are most important to your readers. We’re willing to bet they’re not always your longest.

Here are three reasons why the WriteMark® is right for shorter documents.

1. Short documents often leave a bigger impression on your readers

Consider which of your public-facing documents are the most important to you, and which are the most important to your readers. Are they the same documents? Or are you overlooking other documents that have more impact on your customers’ experience?

Your longest documents might seem the most important, but readers often spend more time and engage more deeply with short, everyday documents |Photo by Beatriz Pérez Moya on Unsplash.

For example, lots of insurance product disclosure statements in New Zealand hold the WriteMark®. A product disclosure statement (PDS) is the main policy document that sets out all the benefits, exclusions, terms, and conditions of cover. It’s an important document for both insurers and their customers.

But many customers will never read their PDS cover to cover. They’ll dip into a few sections as and when they need them. Making the PDS as clear as possible is still vital, but it’s unlikely to be the document that insured customers spend the most time with.

Instead, those customers spend more time on shorter documents: things like policy schedules, application forms, renewal letters, claims processes, websites, and correspondence. These ‘satellite’ documents may seem less important, but they’re the ones customers are actually reading. As a result, they play an outsized part in building confidence and trust.

That’s why getting short documents right can make a big difference, and leave a bigger impression.

2. WriteMark® requirements make short documents focused and functional

The WriteMark® Standard has 25 requirements, ranging from the ‘big picture’ (things like smart structure and clear purpose) to the minute details of language and presentation. Some of these 25 requirements won’t apply to short documents — this makes them easy to meet!

But for many short documents, the WriteMark® requirements can help you consider improvements you might otherwise overlook.

For example, you might think:

- structure is less important when all your information fits on one page

- headings aren’t needed for a document of only a few paragraphs

- a bullet list is unnecessary when you’re only asking a reader to fill out a form.

But following the WriteMark® requirements for structure, headings, and bullet lists — among other things — hones short documents to make them their best, punchiest, most practical versions:

- A smart structure ensures you deliver information in a logical order, so readers build their understanding and know what to do.

- Headings summarise key messages, clarifying purpose and supporting navigation.

- Bullet lists enable readers to scan information easily and create extra white space.

All these elements make long documents simpler and more functional, but here’s the secret: they work for short documents too!

3. Customers expect consistent quality across the documents they read

Displaying the WriteMark® on your biggest documents is a visible commitment to caring about your customers. Adding it to the surrounding constellation of shorter documents creates consistency in your brand values across all your communications.

Customers expect consistency from the businesses and organisations they deal with — even subconsciously. A poorly written webpage or letter template will stand out like a sore thumb. One complex and ambiguous communication can undermine the caring and conscientious brand value reflected in the WriteMark®.

If you can make something as complex as an insurance PDS clear, why leave a claims form or FAQs page in the dense and ambiguous Dark Ages? Achieving the WriteMark® on shorter documents signals a consistent, clear tone across the whole array of interactions you have with your customers.

We can assess short documents in batches, so the WriteMark® is more cost-effective

If you’re concerned about the cost, we can work out a deal. Because it doesn’t take as long to assess short documents, we’re often happy to do them in batches.

This makes it even more cost-effective to achieve the WriteMark® for your ‘daily drivers’ — those short, significant documents that your readers encounter every day.

We’d love to help you get the WriteMark® on your library of short documents. Contact us today to discuss your documents, your readers, and to get a quote.

Send us some information about your short documents and we’ll be in touch

Ryan Tippet June 12th, 2024

Posted In: The WriteMark

Tags: clear communication, financial documents, Insurance writing, Legal documents, WriteMark

Clarity counts when you’re accountable

Clarity counts for business growth. Image by Micheile Henderson / Unsplash licence

Clarity, honesty, and respect all add up for a long-time WriteMark® holder, Kendons Chartered Accountants.

Financial agreements can be taxing, but Kendons has found a way to communicate complex topics with clarity. They recognise that having the WriteMark® on several of their key business documents supports their business need for clear communication.

Kendons’ business terms and key client letters all carry the WriteMark® seal of approval for clarity. And they have done since 2012.

‘We are straight up. We believe in clarity, honesty, and respect. Making a difference for our clients is our thing.’

An ongoing commitment to keeping things clear

Kendons has recently updated their business terms to include changes in legislation. They wanted to make sure that the updated documents would still meet the WriteMark® Standard. The new content covers complex topics, such as anti-money laundering and non-compliance with laws and regulations.

For the Kendons team, getting to the heart of how the changes might affect their clients is important — but so is explaining the changes as clearly and concisely as possible. Kendons also decided to use the update as an opportunity to check existing text.

The result? Kendons is proud to say that their 2021 terms and key client documents continue to carry the WriteMark® — the quality mark of clear communication that shows you care.

Kendons has also championed plain language over the years as a valued sponsor of New Zealand’s Plain English Awards — they’re a company that’s walking the talk and doing good!

View the register of WriteMark® holders

Anne-Marie Chisnall April 19th, 2021

Posted In: The WriteMark, WriteMark Holders

Tags: accountants, accounting, clients, financial documents

Clearly, it’s still Summer

Summer KiwiSaver helps you on your financial literacy journey. Image by John Dame / Unsplash licence

Forsyth Barr continues its plain language journey with the latest update to the product disclosure statement for Summer KiwiSaver. For the sixth year in a row, Summer KiwiSaver has kept its WriteMark status by continuing to commit to clear communication.

The WriteMark® Plain Language Standard shows readers that a document is easy to read and act on.

Trish Oakley, Head of Summer, explains why they’ve consistently sought the WriteMark® as a hallmark of clarity for their document.

‘We want to show our commitment to plain language so that our investors can easily understand KiwiSaver, and make well-informed decisions about their investments.’

Financial documents change, but they needn’t lose clarity

When a document changes, it needs a quick check-up to make sure it still reaches the high standard demanded by the WriteMark®. This time around, the updates were needed to reflect changes to legislation, tax wording, and processes.

‘Summer’s product disclosure statement is a living document’, says Trish, ‘and as it changes, we’ll continue to seek the WriteMark® tick. That way, we’re supporting our investors in their financial literacy — helping them to understand the language of money.’

Clarity inspires trust

Here at WriteMark® we commend providers like Forsyth Barr.

Write and WriteMark® CE Lynda Harris says,

‘Information about investment affects decisions that have a far-reaching impact. Forsyth Barr has committed to clarity in a field that is known for its complexity. Their members can be confident that Forsyth Barr really does ‘walk the talk’ when it comes to putting customers’ needs first.’

Read Summer’s product disclosure statement

Read our earlier story about Summer KiwiSaver

Read Summer’s article about their commitment to clarity on their website

Find out more about getting a WriteMark® assessment

Anne-Marie Chisnall April 16th, 2021

Posted In: The WriteMark, WriteMark Holders

It’s always clear when it’s Summer

It’s always clear when it’s Summer KiwiSaver. Image by David T / Unsplash licence

Forsyth Barr is celebrating Summer this week. Their Summer KiwiSaver scheme’s product disclosure statement (PDS) is shining bright because it has again met the WriteMark® Plain Language Standard. The Summer KiwiSaver PDS is now in its fifth year of reaching this sought-after confirmation of clarity.

The PDS has new content to reflect both legislative changes and changes to risk indicators for some of the scheme’s funds. Investors can still easily learn about how the Summer KiwiSaver scheme works, its risks, and what rights they have when investing.

Trish Oakley, Head of Summer, is determined to keep the standard of clarity high.

The WriteMark® shows our continued commitment to plain English and to making KiwiSaver easy for our members to understand. That way they can make informed decisions.

Each time the document changes, we’ll make sure it continues to hold the WriteMark®. That shows our commitment to transparency and accessibility.

Investing can be straightforward,

not complex

Like the team at Summer, we think clear writing in financial documents is important to help consumers make good investment decisions. You shouldn’t have to be a financial expert to be able to understand the financial information that affects you.

In a field that’s known for complexity, issuing a really clear statement about your product has far-reaching effects. A financial institution can build trust and goodwill by communicating clearly with its customers. And that’s a bright outlook for all of us.

Lock in clarity by getting the WriteMark® on your documents. Image by Daniel Park / Unsplash licence

Discover resources to help you write clear financial documents

How can you get started on creating a clear financial document? Our evergreen advice is to consider your reader’s needs and put yourself in their shoes.

Think about the purpose of your document. Explore ways you can convey complex information simply, so that people who are not financial experts can understand your writing. You’ll find lots of helpful tips in our easy-to-use checklist — the Write Plain Language Standard.

Download Write’s free Plain Language Standard

Download Write’s free ebook Unravelling Financial Jargon

Check out the Financial Markets Authority’s glossary of financial terms on the FMA website

Find out more about getting a WriteMark® assessment

Anne-Marie Chisnall August 20th, 2020

Posted In: WriteMark Holders

Tags: clear language, financial documents, industry standards, KiwiSaver, Legal documents